Gift Deed Format for Cash – An Easy Guide

Are you looking for a simple way to give money as a gift? It’s possible with a cash gift deed, which is an official document that enables you to transfer money from one party to another. In this guide, we’ll show you how to fill out the appropriate paperwork and properly gift Deed Format for Cash.

Drafting Your Gift Deed Format for Cash.

Once you’ve prepared the relevant details and documents, you can begin drafting your cash gift deed. Start by including the date of the transfer, the amount of money exchanged, and both parties involved. Then add a clause stating that there is no consideration for this transaction; it’s simply a way to give money as a present. Next, write out any additional details necessary to validate the deed, such as any conditions of transfer or requirements for disclosure by either party.

Finally, be sure to get all parties involved to sign the document in order to make it legally binding. While drafting cash gift we have to keep in mind all aspect like we keep in mind at the time of drafting property gift deed and gift deed registrations.

Use Clear Terms and Conditions in Gift Deed Format for Cash.

When it comes to writing the cash gift deed, it is essential for each party to clearly understand the conditions of transfer. For example, if you are gifting money to someone in need, be sure that the deed reflects no expectations of repayment or any lack thereof. You should also include a clause that ensures that the giver may not have any claim to ownership over property acquired with gifted money in case of future disputes. Additionally, it’s important that all parties involved fully understand who will have access to and responsibility for any information disclosed as part of this transaction.

GET FREE CONSULTATION FROM GIFT DEED LAWYER NOW

Include the Details of Both Parties Involved in Gift Deed Format for Cash.

It is essential to include the full names and contact information of both the giver and the recipient in the cash gift deed. Additionally, you should document the date and location that the transfer is taking place, as well as any other relevant details. For example, if this money is being given specifically for a particular purpose (e.g., housing), ensure that it is included in your document. Moreover, where applicable, have both parties provide government issued identification such as driver’s licenses or passports to validate their identities.

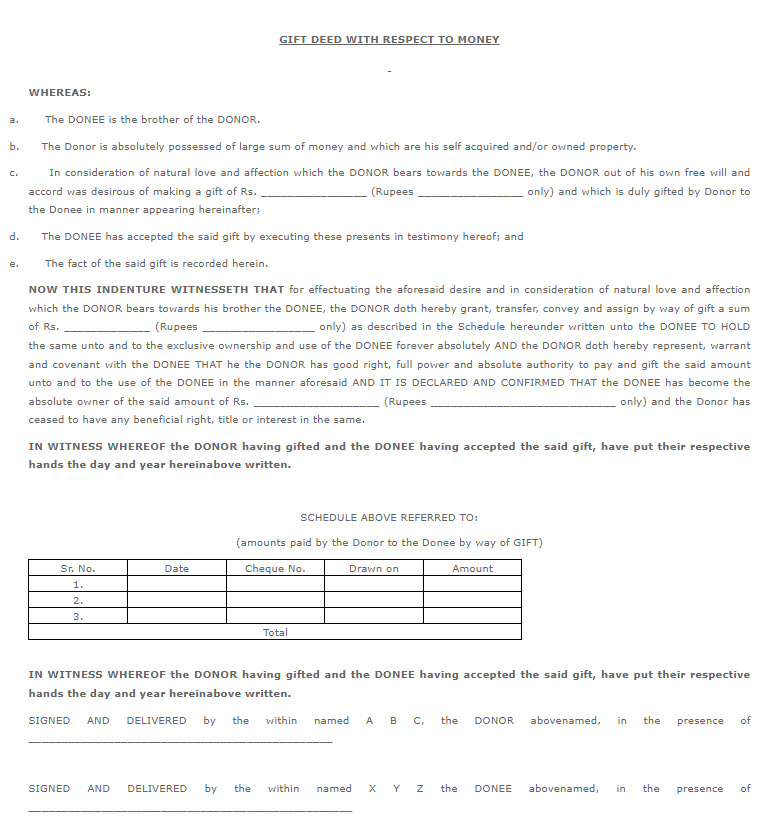

Sample Gift Deed Format for Cash-

Finalize the Gift Deed with a Notarized Document.

Once you’ve completed your cash gift deed document, it is highly recommended to have it notarized. This protects both the giver and recipient from any potential disputes or issues with the transfer of money. A licensed notary public can provide verbal witness and signature verification to confirm that both parties, as well as all relevant details, are in agreement and accurate. Afterward, the final document should be kept in a secure place for future reference.

Source – @carahulagarwal8192

Record the Gift Deed in the Public Records Office or file while filing IT returns.

Once the gift deed has been finalized and notarized, the final step is to record it in the public record so that it may be accessed by interested parties. Contact your local public office and inquire about their filing procedures for recording a cash transfer agreement. Bring photocopies of the deed with you as well as proof of identity for both signatories in order to complete the process. This will ensure that your deed is properly recorded and can be easily referenced in case of any questions or disputes later on.

Is there any tax on gift deed?

Gifts of cash up to Rs. 50,000 are exempt from taxation under the Income Tax Act, however for cash gift to blood relatives there is no limit.

Shreeyansh Legal provides gift deed lawyer in thane, gift deed lawyer in navi mumbai, gift deed lawyer In Navi Mumbai. Our team has best gift deed registration lawyer who will assist clients in efficient manner for gift deed registration in mumbai and gift deed registration in thane. It is easy task to get good gift deed registration lawyer but the question comes about the transparency and credibility.

Our team provides advocate for gift deed registration in navi mumbai and mumbai, gift deed registration in kalyan, gift deed registration in dombivali as per requirement of client considering the overall details and documentation required.

Mostly people expect advocate fees for gift deed lesser… Here team shreeyansh legal comes for help. We also have well experienced and dashing female gift deed registration lawyer. Citizen gets confuse in case of gift deed in blood relation as in some states rules regarding stamp duty on gift deed when gift deed in blood relationtakes place. Our team guides senior citizens when they want to execute gift deed in blood relation regading exact stamp duty payable and documents required.

Get service of gift deed registration in mumbai from Shreeyansh Legal for hassle free Gift deed registration.

References and more to read :

- NEW GOVERNMENT NOTIFICATION REGARDING GIFT DEED AND STAMP DUTY ON GIFT DEED

- RESALE AGREEMENT, STAMP DUTY AND RUMORS…

-

MAHARASHTRA GOVERNMENT AMNESTY SCHEME

-

HOW MUCH DOES GIFT DEED COST

- GIFT DEED REGISTRATION

CONTACT US FOR AVAILING PROFESSIONAL SERVICE FOR GIFT DEED REGISTRATION, GIFT DEED REGISTRATION IN MUMBAI, GIFT DEED REGISTRATION IN THANE , GIFT DEED REGISTRATION IN NAVI MUMBAI, GIFT DEED REGISTRATION IN KALYAN, GIFT DEED REGISTRATION IN DOMBIVALI.